I’m a bit of an oddball, weirdo, or whatever the outsider term is. Basically, I go against the grain.

I’m really not sure if this is something that came from my childhood as not wanting to subject myself to peer pressure, so I chose to be a loner instead and branded myself as The Unpopular Kid. But anywho, it’s led me down a very different path that I’m incredibly grateful for.

Why?

No, it’s not because being The Unpopular Kid was so much fun. Trust me, walking around endlessly trying to not look like a loner in high school wasn’t exactly “fun” in my books. But I simply just didn’t want to hang around people who thought differently – as in, adhering to the social norms. What should they buy, how should they dress, how should they talk to this boy. I couldn’t have cared less cause I had more traumatic shit happening in my home. Like WHERE ARE THE DRUGS?! Okay, jokes – partially.

But survival was more important to me than getting asked to go to the dance.

The beauty of the situation is that this has taught me to question and challenge most societal norms and social conformity. I don’t go with the flow just because the masses are doing it. I form my own opinions.

Just because EVERYONE believes that you need to work a job to retire, doesn’t mean it’s the right path for everyone. And it’s similar on the flip side of that, just because entrepreneurship is glamorized right now, doesn’t mean that it’s for everyone.

As with the subject of budgeting, first you have to understand that there is no one size fits all but also, there are variations on EVERY system. So here’s my take on budgeting for beginners. I’ll walk you through a few of these hacks in this blog today.

Class is in session! Let’s begin.

What is budgeting?

Budgeting, in the simplest form, is to allocate each dollar that you have. Basically, giving each dollar a job to do.

Basic budgeting includes our living expenses which can include rent, utilities, phone, internet, groceries. More advanced would include car payments, subscriptions, diapers for example, and beer. It’s like a necessity, but you can take the bus, watch less Netflix, use cloth diapers, and just don’t drink – but see how life is less fun that way?

So here’s the human element:

Think of budgeting more like a guideline as opposed to rules. (Yes, I’m ripping off Pirates of the Caribbean – but it makes perfect sense here, doesn’t it?)

The term ‘budgeting’ is a phrase I actually find restricting. So instead, I reframe it as tracking my expenses.

The shift that occurs for me is that tracking my expenses is simply having a clear indication of EXACTLY what I need to pay per month, down to the penny. Actually I choose to round this up to the nearest dollar because by doing so, I’m automatically creating a buffer for myself – kind of a no brainer. And then if I don’t need those extract cents, they can either go into my buffer fund or straight into my long term investments.

The main reason we budget is to get a sense of our bills, what we need to pay, how much we have left over and really, at the end of the day, it answers this simple question:

Can I afford to live my current lifestyle?

I know, it sounds a lot less sexy when you call it what is. Budgeting = can I afford my life.

But, fear not. Now that we got that out of the way, let me introduce to you the money jar system (we’ll break this down further below as well).

Basically, the money jar system allows you to more easily allocate your money into “jars” or what I call funds (because I literally have 10+ different funds) so you can comfortably know that all your expenses for the month are covered.

What are the 4 tips for budgeting?

1. Account for the unexpected

There are always going to be things you didn’t account for that month and that’s okay. BUT preferably you pay for this WITHOUT dipping into your savings or your credit. So, how can you avoid this? Create a buffer fund for yourself. I tend to overspend when it comes to food, so I have a buffer fund that’s a guilt-free way for me to dip into if needed.

2. Include ALL your expenses

Sometimes we think we can get away with not tracking the small stuff like a netflix subscription for $12.99 or that slurpee for $1.29 BUT let me tell you, it’s really the small things that add up the quickest! Which is why you should be watching out for them and track ALL your monthly expenses.

3. Round UP on your bills & DOWN on your income

I talked about this earlier, but this one simple move can honestly sometimes create hundreds of dollars throughout the year, especially if you have multiple streams of income. Here’s a concrete example: say, you have a job and a side hustle.

- Your job pays you – $2,983 (after taxes)

- Your side hustle brings in – $428 (after taxes)

- Your living expenses is approx – $2,640

The first thing I’d do is ONLY budget with $2,700. This creates a buffer of $283. Why? Because it still covers my bills and leaves me with extra money… really, it’s that simple. It’s kind of like: make yourself more poor and then leverage that money to grow your wealth. Once this becomes a habit, trust me, it’ll do wonders. Now with those extra funds, you can put them towards your emergency fund, savings, buffer, or investments!

PS – notice how I only used the “job income”. That means after your bills, you still have….

$60 left over from your job income, $400 from your side hustle (yes, I rounded down again) AND that $460 is all gravy. Just saying…. As Maui would say: “You’re welcome”.

4. Plan for your guilty pleasures

Yes, you heard me right. Planning for your guilty pleasures IS one the best hacks in my opinion. Here’s the thing: we are humans. We sometimes WANT to spend for the sake of spending, but “society” has told you that’s bad and you’ll never reach your goals and become wealthy if you do that.

I call bullshit. Send them over and they can come at me. I spend on food weekly AND my portfolio is still up over 70% because I put my money to work for me. So, don’t be afraid to spend on yourself BUT make sure you plan for it so it doesn’t hurt you too much in the long run.

5. Bonus Tip (Use percentages)

I wanted to give you this one extra tip.

Early in my journey, I would get frustrated that I could barely make ends meet. Some months, I simply couldn’t. It was very discouraging whenever I go to budget how I am going to “live” this month.

So instead, I used percentages and this is what it looks like. If there was a big payment coming through like car maintenance that’s several hundred dollars, instead of “oh shit” I would start planning months for it in advance. I actually plan for maintenance items quarterly. How much do I need to put aside a month and use percentages to get there. So here’s what it looks like.

- Car Maintenance – $600/quarterly

- $ needed per month – $150/month

So while I may not be able to make the full $150 payment per month, I can say 5% of my income, or 10%. The objective here isn’t necessarily to pay the full amount (unless you can) but rather to start the action of putting that money aside so you can use it without breaking the bank when you get your car in for an oil change.

Because the worst thing that can happen is you can only put $50/month and when it comes time to take your car in, you have $200 already in the bank and only need to put the remaining $400 on your credit card.

Terrible right?

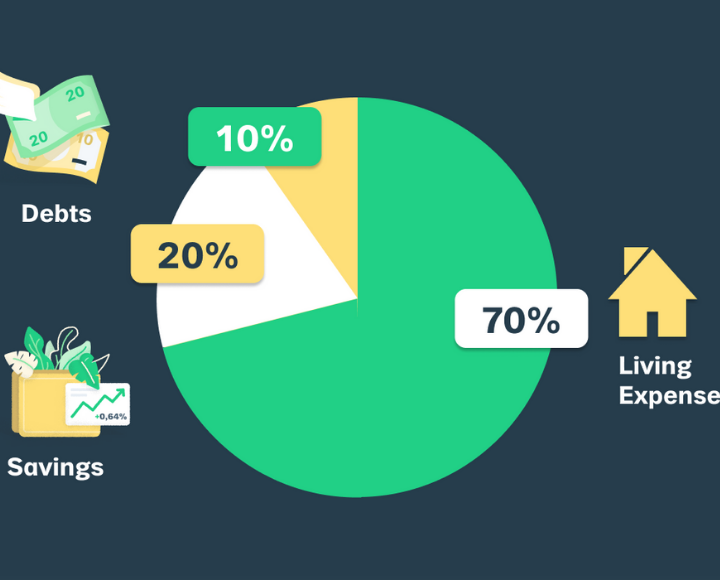

What is the 70 20 10 rule?

Simply put, it’s a budget system for your money.

Too simple? Haha, okay fine, let’s get into more details.

So the 70, 20, 10 rule is ONE system out of MANY when it comes to budgeting your money.

Basically here’s what it looks like:

- 70% – Living Expenses

- 20% – Savings/Investing

- 10% – Debt

Fundamentally this looks like a great idea, but when it comes to putting this into practice, it’s not nearly specific enough for me.

Savings/Investing is 20% but HOW should you be splitting that up?

I referred to this early, but I prefer the money jar system – with a few minor tweaks.

I’m about to spill the tea here with you…. here’s the secret….. Don’t tell anyone I told you this.

You can change the rules of the game…

So the money jar system itself is similar to the 70, 20, and 10 rule. Only difference is it has you splitting your money 6 ways (or into 6 “jars”) and it looks a little something like this.

- 50% – Living Expenses & Necessities

- 10% – Financial Independence

- 10% – Long Term Savings

- 10% – Give

- 10% – Play

- 10% – Education

See how it’s already more specific?

If you’ve been following me for awhile you know I’m an advocate for freedom of choice – especially when it comes to YOUR money.

So here’s how I break down my cash.

- 30% – Taxes (cause I run several businesses)

- 25% – Living Expenses

- 20% Emergency Fund

- 10% – Long Term Savings (this actually is my maintenance fund too btw)

- 10% – Investments

- 5% – Buffer Fund

But “how are your living expenses so low?!” Actually… they’re not. I shifted my mindset. I HATED the idea of having to put over 50% of my money into “bills” so instead, I reversed the math. I looked at how much my expenses were and how much I wanted to put away in each of the other categories, THEN I got clarity in how much I needed to make per month.

Moral of the story: don’t let how much you make right now stop you from planning your IDEAL budget.

The real secret for creating wealth?

Start somewhere, anywhere. But, just start.

I know this was a long post and I hope it was able to offer you a starting point. If you’re new in your wealth journey, you don’t HAVE to do everything at once. Start with one thing first, practice that until you’ve got a handle, and then move onto the next.

There is no rush except for the one you’ve created for yourself, and if your money is withering away in a regular bank account then sure, move it. But honestly, to my readers and to my 99% Tribe, you don’t HAVE to do this alone.

This is my zone of genius and I would love to help you level up your financial literacy game and lay the foundation to creating generational wealth.

Would an 80-100 point increase in your credit score be helpful? Or learning to rebuild your credit score without having to pay 100% of your debt?

My students learn to leverage like the Elite 1% in under 60 days. My promise to you is that we’ll work with you until you feel you’ve got an action plan.